Contents:

Remember to create payment terms in QuickBooks for all customers. This will ensure QuickBooks generates accurate data and timely payment reminders. The A/R aging summary gives an overview of your invoices, grouped in columns by days outstanding (1-30 days, days, days, 91 days and over). The aging detail and aging summary reports are practically identical, showing both current and overdue accounts in different views. Add new jobs under the customer’s name in the Customers & Jobs list to track separate customer balances.

If you don’t have the option to filter your A/R aging report by location, you can read Step 4 in our how to set up advanced settings guide. You can select additional options for your A/R aging report by clicking the Customize button . View your company’s latest transactions with the click of a button. Connect to QuickBooks Online or QuickBooks Desktop to make your company’s accounts receivable simple.

What Are Net Credit Sales?

Additionally, a time limit will be imposed as to when the payment is due. The limit can be 15 – 30 days or longer depending on how lenient a vendor is willing to be. When a company extends credit to its customers, it maintains a separate account receivable for each customer. Use this method ONLY if the invoice is dated within a period that is not closed. Net credit sales means that all returned items are removed from the sales total.

Are you still stuck and don’t know how to find company data files or recent backup files QuickBooks then please … In any case, if you encounter a problem while adjusting account receivables in QuickBooks then feel free to contact us. Select the name of the customer to whom the credit is being transferred from the Name drop-down list.

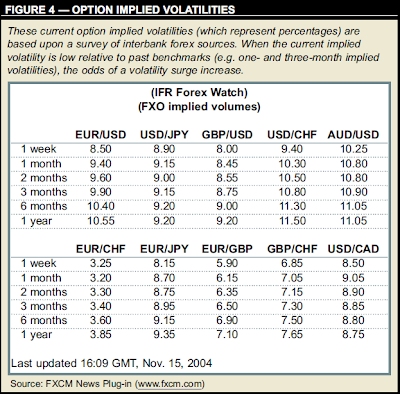

If your business demands for more than one such type of accounts, you can do so. This can be done by monitoring the accounts receivable turnover ratio, which is calculated by dividing the net credit sales by the average accounts receivable. This ratio indicates how quickly each customer pays off their outstanding invoices and gives an indication of the rate of payment collection. The accounts receivable tracking feature in QuickBooks helps ensure that all customer information is accurately tracked and reported. This helps businesses maintain strong customer relationships by providing accurate invoices and records.

- If you enforce a policy, people will either start to pay you on time, or stop doing business with you .

- There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

- Accounts receivable turnover measures how efficiently your business collects revenues from customers to whom goods are sold on credit.

- Accordingly, Net Realizable Value of Accounts Receivable is a measure of valuing the accounts receivables of your business.

That is, you subtract the allowance of doubtful accounts from accounts receivable. This is done to calculate the net amount of accounts receivable anticipated to be collected by your business. Further, goods sold on credit have a risk of non-payment attached to them. Thus, bigger the difference between Gross Receivables and Net Receivables, bigger the issue with your business’ trade credit and collection policy. Further, on the day when the payment is made, Lewis Publishers will record such a payment in the following manner.

Sage Accounting

Doing so can help you identify any problems quickly and take corrective action where necessary. The final step to managing accounts receivable is to write everything down. Accounts receivable balances that will not be collected in cash should be reclassified to bad debt expense.

BILL and BMO Debut Bill Pay and Invoicing Tool – PYMNTS.com

BILL and BMO Debut Bill Pay and Invoicing Tool.

Posted: Thu, 09 Mar 2023 08:00:00 GMT [source]

Here, you can choose which information to display in the header and footer of the A/R aging report. Locate the menu bar above the A/R aging summary report by scrolling up the screen. The menu bar provides some general options that can be adjusted. Unapplied payments are more common in pre-2006 versions because the system did not offer as many prompts for applying payments and credits as the more recent versions. A quick way to find out if you have any unapplied payments is to run a report called “Open Invoices” under Reports – Customers and Receivables. If you have set up your QuickBooks account to do job costing correctly, the aging summary will show a breakdown of open projects under each customer.

How to Export a Quickbooks Customer List

Mark Calatrava is an accounting expert for Fit Small Business. Our QuickBooks tutorial series, which includes this guide, is intended to help you maximize the functions of QuickBooks Online, our best small business accounting software. We recommend you follow along with your QuickBooks account open. If you don’t have one, head over to Intuit’s website to sign up for a 30-day free trial or 50% off for three months.

If you see negative numbers in the Accounts Payable or Accounts Receivable here, you you have a problem. It is also important that your payments are not dated prior to your invoices, so be sure to avoid this during your regular processing. Double click on any line on the report to take you to the original transaction. From the transaction, click on the history button at the top of the window for more information and to jump to the linked payment or invoice. From the chart of accounts, double click on undeposited funds to open the register.

Accounts Receivable Turnover (in Times)

It can be challenging to keep track of your outstanding invoices. As a business owner, keeping on top of outstanding invoices is crucial to your financial health and longevity. Aside from improving cash flow, one of the main priorities for construction companies when reviewing A/R is tracking their lien rights. A mechanics lien is the most powerful tool in a contractor’s collection toolkit, but it has an expiration date. Every state has a specific deadline by which contractors must file a lien claim, often based on the last day you provided work or materials in an invoice. Occasionally, you may discover that customer payments have been applied to the wrong invoices making it difficult to figure out where the problem lies.

When you record a payment from a customer, QB automatically moves that amount from A/R to Cash. You can generate the reports using the accounts receivable account post navigation to the chart of accounts. You can also select amount the creation of the sales order and an estimate. Users do not required to create both of these forms to create the accounts receivables. By following the aforementioned steps, you will be able to adjust accounts receivables easily in QB.

Step 2: Record a Payment Against the Invoice

Ken is the author of four Dummies books, including “Cost Accounting for Dummies.” Company bookkeeping may require your firm to post dozens of receivable transactions each week. Sign up to a free course to learn the fundamental concepts of accounting and financial management so that you feel more confident in running your business. According to the above example, a customer on an average takes 65 days to pay for the goods purchased on credit for Ace Paper Mills.

Accounts Payable account would be debited by $200,000, Cash Account would be credited by $198,000, and Paper Account would be credited by $2,000. Now, let’s have a look at the differences between accounts receivable and accounts payable. However, there are times when you purchase goods on credit from your suppliers. Thus, such a credit purchase is recorded as Accounts Payable in your books of accounts. Now, you record the money that your customers owe to you as Accounts Receivable in your books of accounts. Check the journal entry you created under the Outstanding transactions section.

- Yes, accounts receivable should be listed as an asset on the balance sheet.

- As per Accrual System of Accounting, you record Allowance for Doubtful Accounts so that you get an understanding of the amount of bad debts that can occur in future.

- Knowing how to fix negative accounts receivable in QuickBooks is important in order to ensure that your books are accurate and that you are able to collect the money owed to you.

- This allows you to quickly identify potential collection problems to address.

- Click on the “Discounts and Credits” button in the lower left hand corner and apply the out-standing payments or credits that appear in the “credits” tab.

- Set up aServiceitem code titled AP/AR Offset, and have the item code account assigned to the AP/AR Offset account you set up in Step 1.

However, if such a receivable takes more than one year to convert into cash, it is recorded as a long-term asset on your company’s balance sheet. Accounts receivable is recorded as the current asset on your balance sheet. This is because you are liable to receive cash against such receivables in less than one year. This amount is recorded in the provision for doubtful accounts. Thus, the Bad Debts Expense Account gets debited and the Allowance for Doubtful Accounts gets credited whenever you provide for bad debts.

We have mention every small information on the subject which 501c3 meaning you to know the process in detail. After that, you need to enter the check number if the payment has been made by a check this is required to have a record of the entry. It helps the user to have a record for the money payments from all debtors. Dancing Numbers helps small businesses, entrepreneurs, and CPAs to do smart transferring of data to and from QuickBooks Desktop. Utilize import, export, and delete services of Dancing Numbers software.

Construction Accounting Assistant – Axios Charlotte

Construction Accounting Assistant.

Posted: Tue, 21 Mar 2023 07:00:00 GMT [source]

Input a number in the Number column and select the “Customer” drop-down list to choose the customer. You will be able to identify any remaining problems such as the ones mentioned in items 1-8 at the beginning of this article.. Click “Next” to save the account and create a new one, or click “OK” to save and exit.

If you are a WordPress user with administrative privileges on this site, please enter your email address in the box below and click “Send”. Next, set up the mapping of the file column related to the QuickBooks field. Dancing Numbers template file does this automatically; you just need to download the Dancing Number Template file. To use the service, you have to open both the software QuickBooks and Dancing Numbers on your system. To import the data, you have to update the Dancing Numbers file and then map the fields and import it. You need to click on Next to save the account and create a new one, or hit OK to save and exit.

In the Delete process, select the file, lists, or transactions you want to delete, then apply the filters on the file and then click on the Delete option. You can also add any additional information if required including address, contact number and sales tax information, in the appropriate columns. Hit on the Next to save and enter more customer information, or hit OK to save and exit. After that, click on create an invoice from Sales Order/ Estimate and choose on the basis of the document which was created in the previous steps and now click on save and close. Every business should maintain a written procedures manual for the accounting system, and the manual should include specific procedures for managing accounts receivable.